Plastiq holds a special place in the miles and points community because it allows you to take bills that can only be paid by check and pay them by credit card. Plastiq is the middle man, swiping your card and mailing a check to the vendor.

Of course, there is a catch: The 2.5% fee. (Although, once you are enrolled in Plastiq they send out various promotions, like pay a certain amount and get fee free dollars for your next payment, often cutting your average fee to 1.25%.)

Still, when it comes to meeting minimum spend on new credit cards for the bonus, it can come in *very* handy. You can also offset the fee by referring your friends (the links in this post are my own referral) which earns you Fee Free Dollars that offset the fee. They are simple: 1,000 FFDs covers your fee on $1,000 in payments.

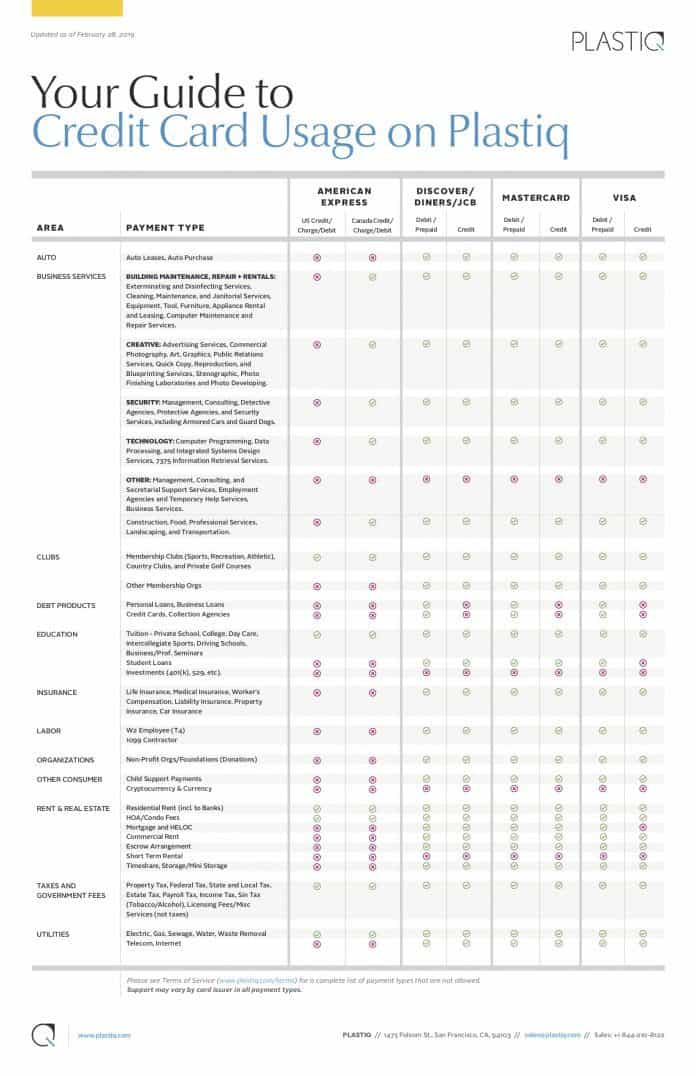

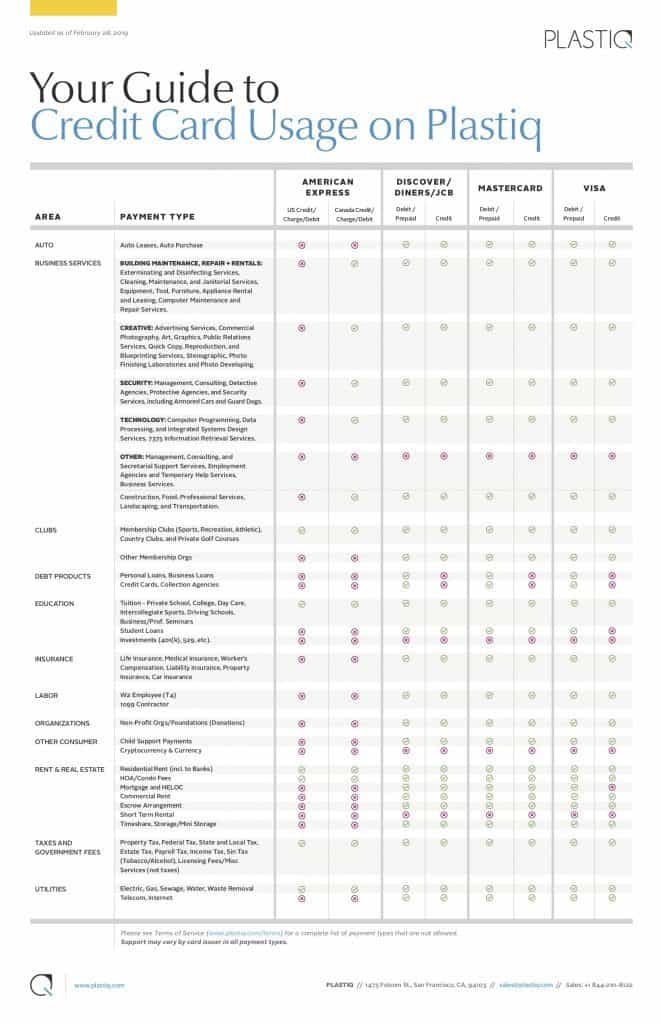

The most confusing part of mastering when and how to use Plastiq is the various restrictions that different card issuers have. American Express won’t allow you to pay 1099 contractors nor a mortgage, while Visa and Mastercard will. Mastercard allows a Mortgage or HELOC to be paid with Plastiq, but Visa doesn’t. And no issuers allow you to use Plastiq to buy crypto.

Happily, now there is a master chart provided by Plastiq to navigate this.

Hopefully this helps!

Let me know if you have any questions! Ask me here, on Twitter, or in the private MilesTalk Facebook group.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available now.

![[Today] Bilt Celebrates New Alaska Partnership on Rent Day (Transfer Bonus + Status Offer) bilt and alaska](https://milestalk.com/wp-content/uploads/2024/03/Bilt-x-Alaska-Airlines-3-218x150.png)

![Should you Pay Taxes with a Credit Card? [2024]](https://milestalk.com/wp-content/uploads/2016/04/cropped-miles2-2-218x150.jpg)

[…] If you missed it, I also have a post showing exactly which cards can pay which kinds of bills with Plastiq. […]