Last week, I introduced you to Bask Bank, a subsidiary of Texas Capital Bank, N.A. just as BankDirect is. It’s a true modern-day version of the original concept, where you earn American Airlines AAdvantage® miles instead of cash interest. Deposits are FDIC insured up to $250,000.

In this article

Earning Miles vs. Earning Cash with your Savings

The decision to choose to place your money in an account that earns miles instead of cash interest is a personal one, and it’s part of your personal finance and personal travel goals.

If you need cash to pay other bills, you probably want to stick to an online savings account earning interest – and I wouldn’t take less than 1.7% in the current interest rate environment. I personally use Marcus by Goldman Sachs.

But let’s assume that you have more spare cash than you need for a rainy day or your personal financial goals and that you also, since you are MilesTalk readers after all, have lofty personal travel goals.

You’d love to fly in the Etihad First Class Apartment or enjoy crazy expensive champagne in a Japan Airlines First Class cabin. But you certainly are never going to pay $20,000 for it!

Let’s also assume that you, as a MilesTalker, are already earning American Airlines AAdvantage® miles in other ways. By flying, sure, but maybe you also have an AAdvantage® credit card and are enrolled in their programs that earn you miles for shopping and dining.

? Limited Time Offer: Get 65,000 bonus AAdvantage® miles when you spend $4,000 in 4 months with a CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®. ?

Accumulating Enough Miles for Specific Travel Goals

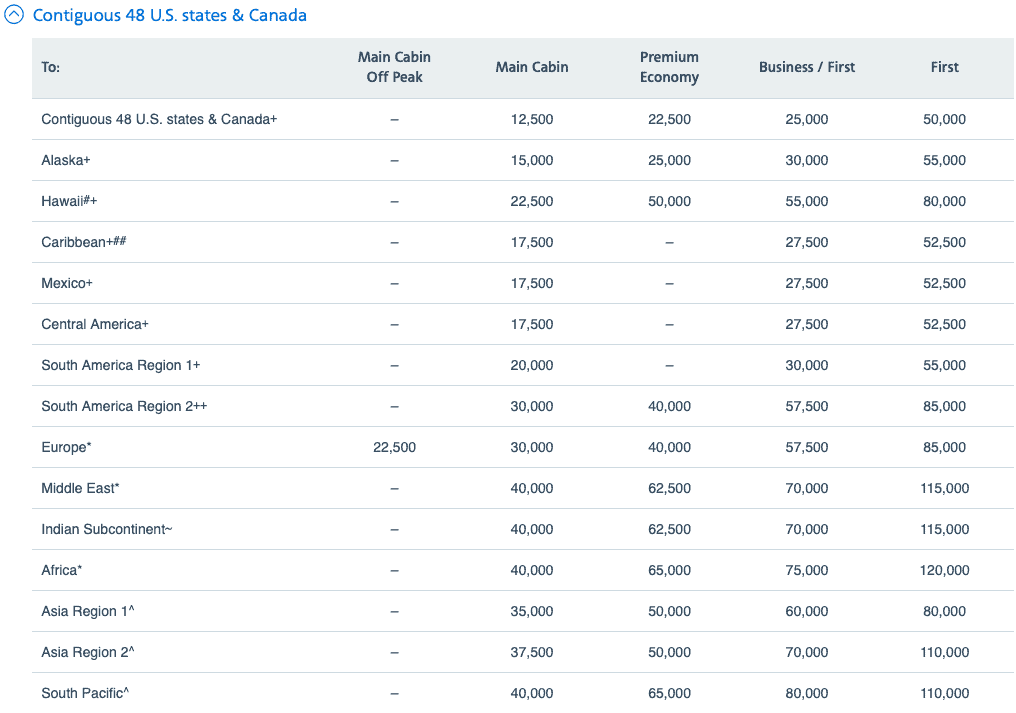

But you need more. First class isn’t cheap. The First Class cabin on Japan Airlines (JAL) runs 80,000 AAdvantage® miles each way, and the Etihad Apartment costs a cool 115,000 AAdvantage® miles one-way to the Middle East or 120,000 AAdvantage® miles to Africa (via Abu Dhabi).

This is where Bask Bank comes in. By diverting as much of your available savings account as possible to a Bask Savings Account, you can earn enough to meet your travel goals much quicker.

Here’s an example:

You already have a balance of 60,000 miles in your AAdvantage® account from other means, but you don’t fly all that often. Your dream trip is a First Class round trip on JAL (maybe inspired by my flight review? ;)) to Japan.

We know from the AAdvantage® partner award chart that this will cost 160,000 AAdvantage® miles.

You need 100,000 more to achieve your travel goals.

And a Bask Savings Account will put you over the finish line if you plan properly.

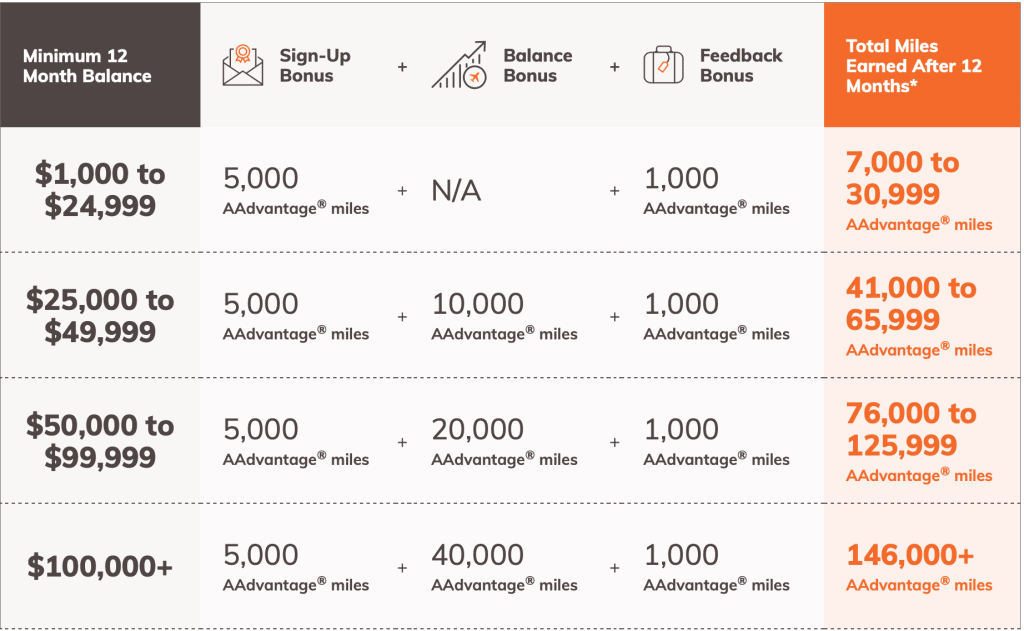

Let’s take a look at the chart Bask Bank has online right now, as I referenced in my earlier post “Introducing Bask Bank: Earn Miles With A Savings Account.”

To earn 100,000 AAdvantage® miles, you have options. You can put more money in and earn the miles quicker, or, if you don’t have enough spare cash to do that, you can calculate how long the funds you have will take to help you reach your goal.

For example, including all bonuses, you could do either of the following to meet your goal within one year:

Put $148,000 in a new Bask Savings Account for 6 months. This would earn 74,000 miles for the standard interest, plus 20,000 bonus miles, plus 6,000* more miles for the new account bonus and the feedback bonus.

Put $74,000 in a new Bask Savings Account for 1 year. This would earn 74,000 interest miles plus 20,000 bonus miles, plus 6,000* bonus miles.

Obviously, this is just as an example. If you needed exactly 146,000 miles, that would be the easiest math. As you can see from the chart above, exactly $100,000 in a new account for a year would get you that amount.

I don’t see any reason to put in less than $100,000, if you have that sitting in an equivalent savings account, with standard interest rates as low as they are now.

Bask Savings Account Bonus Offer Terms:

* Feedback Bonus: AAdvantage® miles awarded within 10 business days upon meeting offer qualifications. Must provide feedback through Bask Bank’s online banking portal or mobile application by June 30, 2020. See Bonus Miles Terms & Conditions for Feedback Bonus offer details. https://www.baskbank.com/special-offers#feedbackBonus.

Account Opening Bonus: Must hold a minimum balance of $5,000 for 90 days within 120 days of opening an account. AAdvantage® bonus miles are awarded within 10 business days upon meeting offer qualifications and may take 6-8 weeks to post to your AAdvantage® account. Offer valid through June 30, 2020. https://www.baskbank.com/special-offers#openingBonus

Balance Bonus: Must maintain a minimum account balance of $25,000, $50,000 or $100,000 for 12 months within 60 days of account opening to qualify for up to 10,000, 20,000, or 40,000 AAdvantage® bonus miles respectively. AAdvantage® miles awarded within 10 business days upon meeting offer qualifications. Offer valid through June 30, 2020. See Bonus Miles Terms & Conditions for Balance Bonus offer details. https://www.baskbank.com/special-offers#balanceBonus

Comparing the Mileage Interest Value vs. the Cash Interest Value

As with most things in life, every opportunity has an associated opportunity cost. In this case, I think that, assuming you have First or Business Class travel ambitions, the tradeoff works clearly in your favor earning AAdvantage® miles.

I value AAdvantage® miles at 1.5 cents each. That represents the minimum value at which I advise people to spend their AAdvantage® miles vs. cash. If a flight costs 20,000 miles or $300, that would be the threshold at which, if the price is $300 or higher, I’d advise to consider spending miles. Under that threshold, definitely pay cash. That doesn’t mean you always redeem for that. Your total balance and whether you are saving for a big award redemption are also factors.

When I redeem for First and Business Class awards, I’m usually getting many multiples of that. A Business Class award can easily be 2-4 cents or more in value against the cash price. A true international First Class redemption, like JAL First Class, can top 10 cents a mile. And while you’d most likely never pay, for example, $29,000 for a First Class flight, you’re also not going to experience it if you don’t spend either the cash or the miles.

These aspirational flights are what I think miles and points are all about. So, if you are like me and will spend your miles on these trips of a lifetime, let’s run some math on the value and the opportunity cost after factoring in earnings and taxes.

To make things easy, I’m going to assume an investment of $100,000 and a total tax rate of 40%.

The correct comparison for a Bask Savings Account would be a standard online bank like Marcus by Goldman Sachs, which is currently yielding 1.7%. You can’t compare this to the stock market or anything like that because this is “risk-free” cash, meaning that it’s FDIC insured up to $250,000 and you can withdraw it at any time.

If you put $100,000 in Marcus for one year, assuming an exact one-year time frame and a steady interest rate of 1.7%, you would earn $1,700. You would receive a 1099 for income of $1,700 and you would then “pocket” $1,020 after paying $680 in taxes.

If you put that same $100,000 in a new Bask Savings Account, you would earn 146,000 miles (see chart above). You would then be issued a 1099 for taxes showing $613 in earned interest, meaning that you’d owe – at a 40% tax bracket – $245 in taxes.

Head to Head: Miles vs. Cash

In summary, you could have either $1,020 in cash or 146,000 miles (minus $245 in taxes).

What can you do with 146,000 AAdvantage® miles? I’ll refer again to the AAdvantage® partner award chart which I’ll paste below (valid as of January 2020).

As you can see, this will be enough miles to fly round-trip just about anywhere in the world! The only places you couldn’t *quite* reach would be Africa (but just 4,000 more miles would get you there!) or the South Pacific (for which you would need 14,000 more miles). You could also mix and match First Class one-way and Business Class back to a lot of regions. For example, you could fly to Japan in First Class and back in Business Class for 140,000 miles.

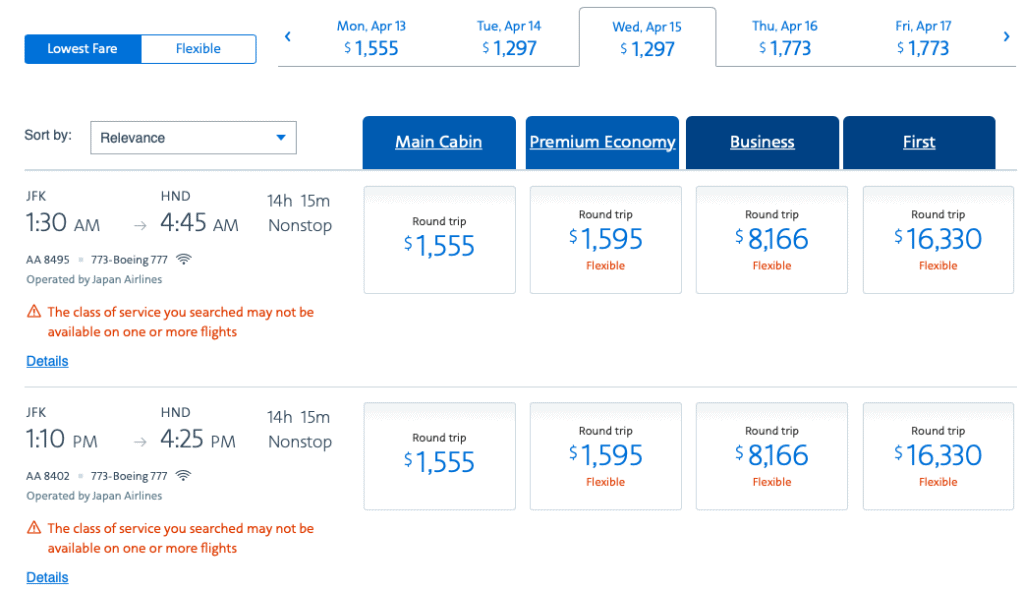

Let’s sample, using AA.com, the cost of a cash flight to Japan in First, returning in Business. I picked travel on a Wednesday (a less popular travel day) to avoid skewing high.

That’s about $12,000 round trip if you mix and match.

But, to be clear, the fares that AA sells for JAL are “refundable,” meaning full fare. You could do better than that.

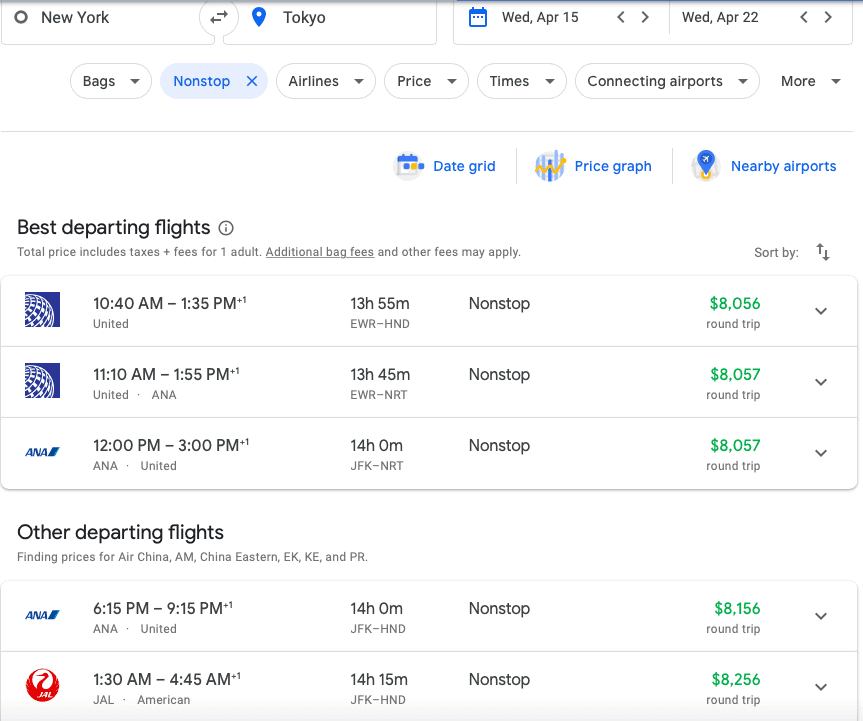

But even if I search Google Flights for JUST business class, I’m seeing fares of $8,000.

This means that for the equivalent of $1,265 (I’m adding the opportunity cost of the $1,020 you didn’t get in interest plus the $245 cost of paying the income tax on the miles in the above example), you are getting a ticket that costs somewhere between $8,000 and $16,000. If you add in just a few more miles (14,000 more miles to be precise), you’ve got enough miles for the round trip in First Class or a $16,000 minimum value for $1,265.

One more example:

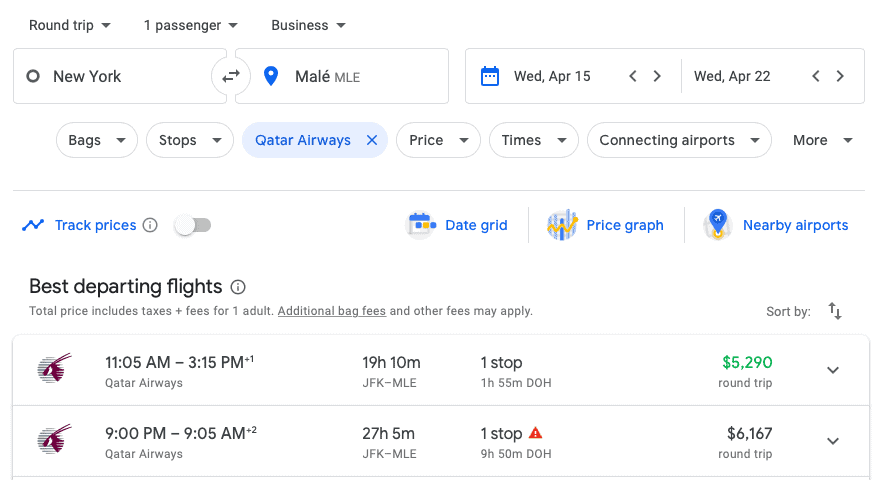

Let’s say you want to fly Qatar Airway’s Qsuites to the Maldives.

A Qatar Airways QSuiteCash price is a generally a minimum of $4,000 to $5,000 round trip.

Your 147,000 earned miles cover this round trip entirely (subject to award space availability, of course!), meaning you are getting a $5,000 ticket for $1,265.

That is the power of miles.

Viewed another way, you earned more than a 5% effective yield in “interest,” because you got something worth $5,000 for $100,000 invested for a year. That’s an incredible yield for money in a risk-free, FDIC-insured savings account. Different airlines and routes have different cash costs, so there’s no exact value I can give you. But I can safely say that if you spend a bit of time learning how best to use American Airlines AAdvantage® miles, a Bask Savings Account will earn you well more in experiences than regular cash interest ever would.

Want more ideas on how to redeem AAdvantage® miles? See this piece about my 5 favorite American Airlines AAdvantage® redemptions.

You can signup for a Bask Savings Account here.

Will you be putting some money into a Bask Savings Account?

Let me know here, on Twitter, or in the private MilesTalk Facebook group.

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

Bask Bank and BankDirect are divisions of Texas Capital Bank, N.A. Member FDIC. The sum of your total deposits with (i) Bask Bank; (ii) BankDirect; and (iii) Texas Capital Bank, N.A. are insured up to $250,000. Additional coverage may be available depending on how your assets are held.

![[Last Day for Old Pricing – March 25] Hyatt’s Yearly Category Changes Are Up Impression Isla Mujeres by Secrets](https://milestalk.com/wp-content/uploads/2023/12/SEIIM-P0007-Main-Pool.16x9.jpg-218x150.webp)

Good topic and decent points, but you’re forgetting the ability to get large bank bonuses using cash on hand, AND maybe even more importantly the fact that leaving 100k in cash over a year, will on average cost you $6-8k in opportunity cost vs a broad market index fund pre-tax. Think cash will always win

+1 to the comment on bank bonuses… There are also a number of references to FDIC in this post; however, it should be noted that although the principal investment with Bask is insured, AA miles are most definitely not. AAs T&Cs are clear that they have the right to modify or eliminate the program entirely. So, you will be paying interest (in cash) on an asset that you don’t own and that has historically devalued over time (and could end up being worth nothing). I think the article should also be clearer that if you aren’t looking at using the miles for business/first flights, this is a lousy investment (even at 1.5 cents/mile, which I consider generous) as you won’t come out ahead of the current interest rates (and on that note a comparison should really be made to a 1-year CD instead of a high-yield savings since you need to let Bask have your money for a year before they pay the bonus). Couple that with the bank bonuses previously mentioned and it doesn’t make sense for those accruing miles for economy class flights.

I think it’s worth it. The problem is the bank is completely incompetent. There was a minor problem with the way we wrote our check which caused it to be rejected by our bank. (At the time you couldn’t deposit $100k in less than 30 days so a check was the fastest way.) That caused Bask to lock up our account. It’s been almost 4 weeks and no amount of calls or emails can get them to open it. They just say “we’ve referred it to our fraud department.” Between two of us we had about 6 additional issues which were resolved. They are nice people but obviously were not prepared for the attention they have gotten.

If you are getting a referral bonus on these accounts I would suggest you find someone there who will help the people who are having issues.

Good idea in theory. What’s the experience one year later? I have $100K to “invest.” For me, 146K miles for $245 in taxes plus, let’s say, 5% lost in interest, equals $5,245. This is a no-brainer. However, where did you find the amount they value points at and report to the IRS. I have looked through all of their fine print – no mention at all of the exact amount – just a generic phrase about fair market value. And two, why has this program/promotion not taken off in over a year? Is there something with the bank?

For 2020, they did send out 1099 forms with the miles listed at 0.42c each. I do see it’s no longer specified in their written terms, which may be because they don’t know if they will receive guidance requiring a change and don’t want to be bound to that, but they did just issue the 1099s for last year and that was the listed value.

To your other question, I don’t know how the program is doing, but assuming it’s like everything else in travel, there was probably a decrease in interest the middle part of 2020 and they are likely having a surge in interest now as people get back to planning travel. To their credit, they never unpegged from 1 mile per dollar even as interest rates dropped and dropped and dropped. When I wrote this you could get 1.7% risk free at Marcus. Today, you can get just 0.5% at Marcus. Meanwhile, the Bask Bank “interest” in miles has not decreased at all. So you could say the value prop has tripled since I published this…