If you have more than one credit card (and let’s face it, most of you reading this do), keeping track of all of your cards’ rewards, annual fees, offers, and earnings can sometimes feel overwhelming. Fortunately, there are several new emerging apps to help you manage your cards. Here are five apps for tracking credit card rewards.

In this article

Credit Card Rewards Tracking Apps

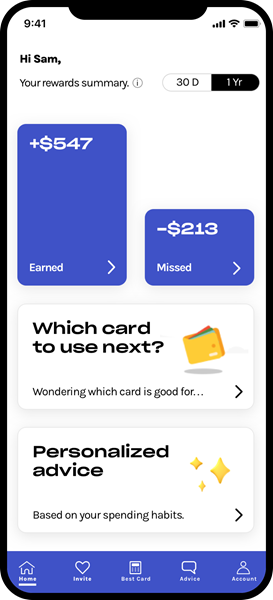

UThrive

How data is pulled

Users manually enter data into UThrive.

Data security

UThrive uses 256-bit SSL encryption and security practices. UThrive does not store sensitive information including credit card numbers or login credentials.

Core features

The UThrive app shows the rewards that you earned and missed across your cards including both cash back and travel rewards based on your transactions. When shopping online or in person, UThrive makes recommendations for the best card to use, and alerts you when you use the wrong card.

UThrive makes new card recommendations based on your spending habits and credit profile, and offers personalized advice on how to optimize rewards based on expected future spending.

With the app, you can track your progress towards qualifying for credit card welcome offers.

Cost

The UThrive app is free to download and use.

Who The App Is Best For

UThrive is best for people who have a few different cards and want some help keeping track of which card to use for which purchase.

Best Aspects

UThrive alerts you when you use the wrong card for a purchase, and allows you to easily see which card to use to maximize earning. This can be very helpful when you are out shopping.

Areas For Improvement

A reminder about upcoming annual fees would be a great addition to this app.

Where To Find the App

UThrive can be found at https://www.uthrive.club/ and on the Apple Store or Google Play.

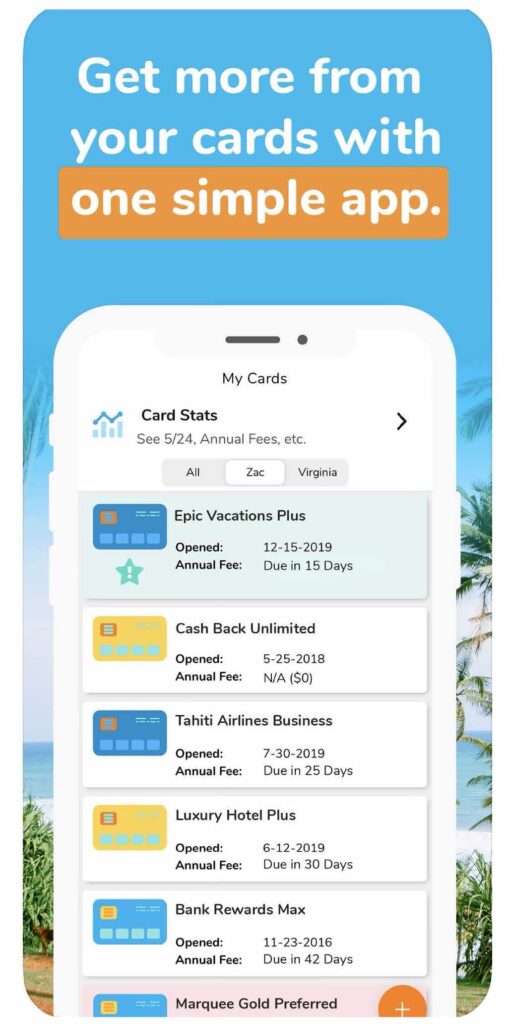

TravelFreely

How data is pulled

Users input data manually, including the name of the cards and opening dates.

Data security

TravelFreely uses high level security encryption and SSL certificates. However, it does not ask for any sensitive credit card information, such as credit card numbers, bank login information, or social security information.

Core features

TravelFreely keeps track of your credit cards and the signup bonuses available to you and it makes personalized credit card recommendations to maximize rewards. The app emails users about upcoming bonus spending deadlines, annual fees, and renewal dates.

For beginners, it offers a beginner quick start guide to learn about credit score monitoring, rewards programs, and best practices for applying for credit cards.

Cost

TravelFreely is free to download and use.

Who The App Is Best For

This app is great for beginners, as it offers a beginner quick start guide and makes recommendations for other cards to apply for.

Best Aspects

The CardGenie tool displays credit cards that you are eligible for, all in one spot.

Areas For Improvement

TravelFreely does not keep track of your card points balances, so you will need to to keep track of that separately.

Where To Find the App

TravelFreely can be found at https://travelfreely.net/ and on the Apple Store or Google.

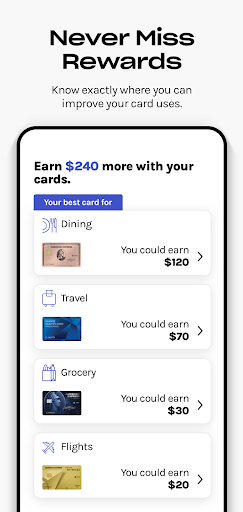

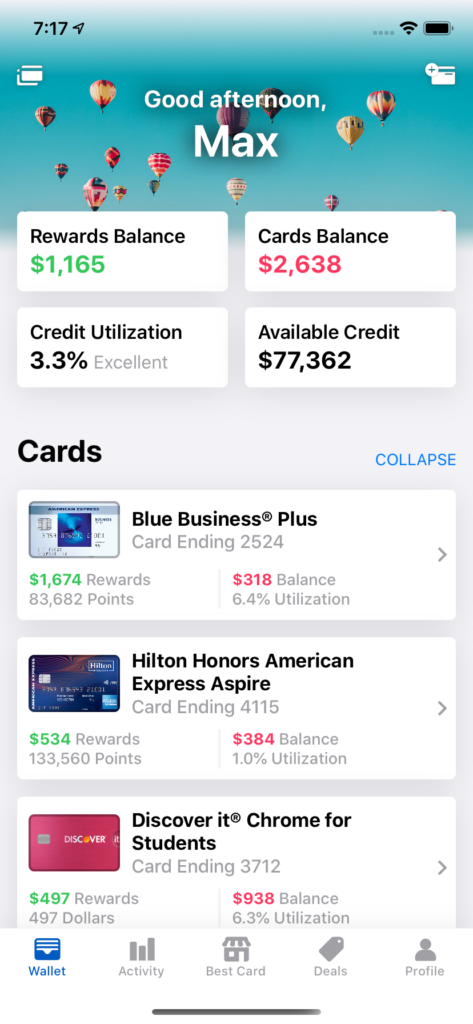

MaxRewards

How data is pulled

The user manually links their bank accounts and the app pulls the data.

Data security

MaxRewards uses bank-level 256-bit encryption to transfer and store information. The app uses a different encryption key for each user so that one compromised account has minimal impact. Account credentials are only stored on secure data systems and are protected by firewalls. All data is stored on Google Cloud and AWS. MaxRewards does not sell any data and their system is proprietary.

Core features

With MaxRewards, you can see your total rewards balance, card balances, credit utilization, and available credit across all accounts. You can also view upcoming credit card bills and autopay statuses, so you never miss a payment. MaxRewards lets you view your credit scores and credit history from all of your connected accounts, as well as transactions and reward activity across all cards on one screen.

Keeping track of sign-up bonuses, bonus spending categories, and special offers are some of the most involved aspects of credit card rewards. MaxRewards helps by automatically tracking all of these. The app tracks spending towards a sign-up bonus and its minimum spend requirements. The app also automatically activates quarterly bonus categories for applicable cards, and continuously activates offers and deals on eligible cards.

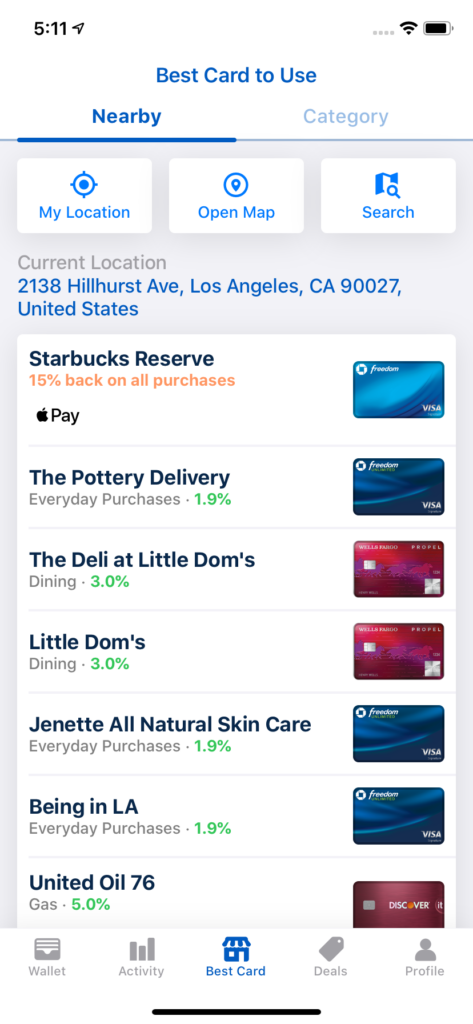

MaxRewards uses your current location via your phone’s GPS to make recommendations for the best card to use based on nearby stores or restaurants. If you don’t want to enable GPS, you can also search a map for nearby recommendations.

MaxRewards knows that many people have their own personal valuation for different rewards systems. The app allows you to refine point valuations based on your redemption expectations.

Cost

The majority of the app’s functionality is free. Gold membership is the app’s premium service and includes extra features. MaxRewards Gold members actually chose their own monthly price. Gold membership features include auto-activation of quarterly bonus categories and other deals, tracking remaining spend on rewards with limits, maximizing savings with offers and deals factored into Best Card, and the ability to favorite, sort and search deals from all your cards. Gold members also receive notifications for new and expiring deals and priority support.

Who The App Is Best For

MaxRewards tracks a lot, and does so automatically, so it is best for people with several credit cards who want to keep most of their tracking information in one space, so long as you are comfortable providing your login details.

Best Aspects

MaxRewards tracks things like your progress toward your sign-up bonus and spending in bonus categories, which a lot of other apps do not.

Areas For Improvement

Some users complain that even though you chose your own monthly price for Gold membership, the minimum prices are still rather high.

Where To Find the App

MaxRewards can be found at https://maxrewards.co/ and on the Apple Store or Google Play. (You can use the MilesTalk referral link for a free month of the premium Gold account).

Cost

The majority of the app’s functionality is free. Gold membership is the app’s premium service and includes extra features. MaxRewards Gold members actually chose their own monthly price. Gold membership features include auto-activation of quarterly bonus categories and other deals, tracking remaining spend on rewards with limit, maximize savings with deals factored into Best Card, and the ability to favorite, sort and search deals from all your cards. Gold members also receive notifications for new and expiring deals and priority support. (Again, you can use the MilesTalk referral link for a free month of the premium Gold account).

CardPointers

How data is pulled

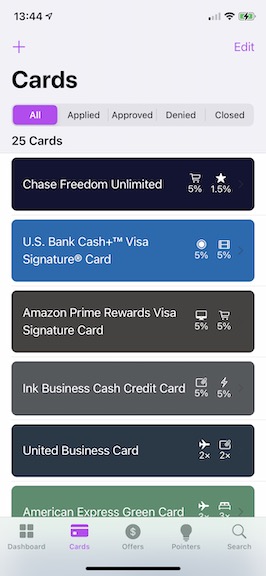

Users manually input the cards that they have into the app.

Data security

CardPointers does not ask for personal credit card information. The app only collects the type of card.

Core features

CardPointers tracks credit card offers, including monthly and annual credits, as well as credit card annual fees and renewals. The app makes personalized recommendations based on your existing cards and preferences. CardPointers uses iOS 15 widgets, Safari Web Extension, Location Reminders, Siri shortcuts, and a new dashboard – all available to use without launching the app.

Cost

The app is free to download and use.

Who The App Is Best For

CardPointers is best for someone who has a few credit cards and wants help keeping track of annual fees, credits, etc., but does not want personal credit card information to be linked to an app.

Best Aspects

CardPointers reminds you about expiring credit card offers and upcoming card annual fees.

Areas For Improvement

A geolocation feature that would show which card to use based on the user’s location could really elevate the experience of this app.

Where To Find the App

CardPointers can be found at https://cardpointers.com/ and on the Apple Store. It has a Chrome Web Extension download option.

Card Curator

How data is pulled

With Card Curator, the user manually enters data into the app. Users can also sync up with their CC Secure Connect tool, which will automatically pull all the transactional data from their credit cards and input all of their credit cards into the app. Users also have the option to sync up to AwardWallet to pull all of their rewards data.

Data security

Card Curator never asks for bank account details, full credit card numbers, security codes, passwords, banking information, or any financial information. Secure partners MX and AwardWallet are used to access transaction information and rewards point balances.

Core features

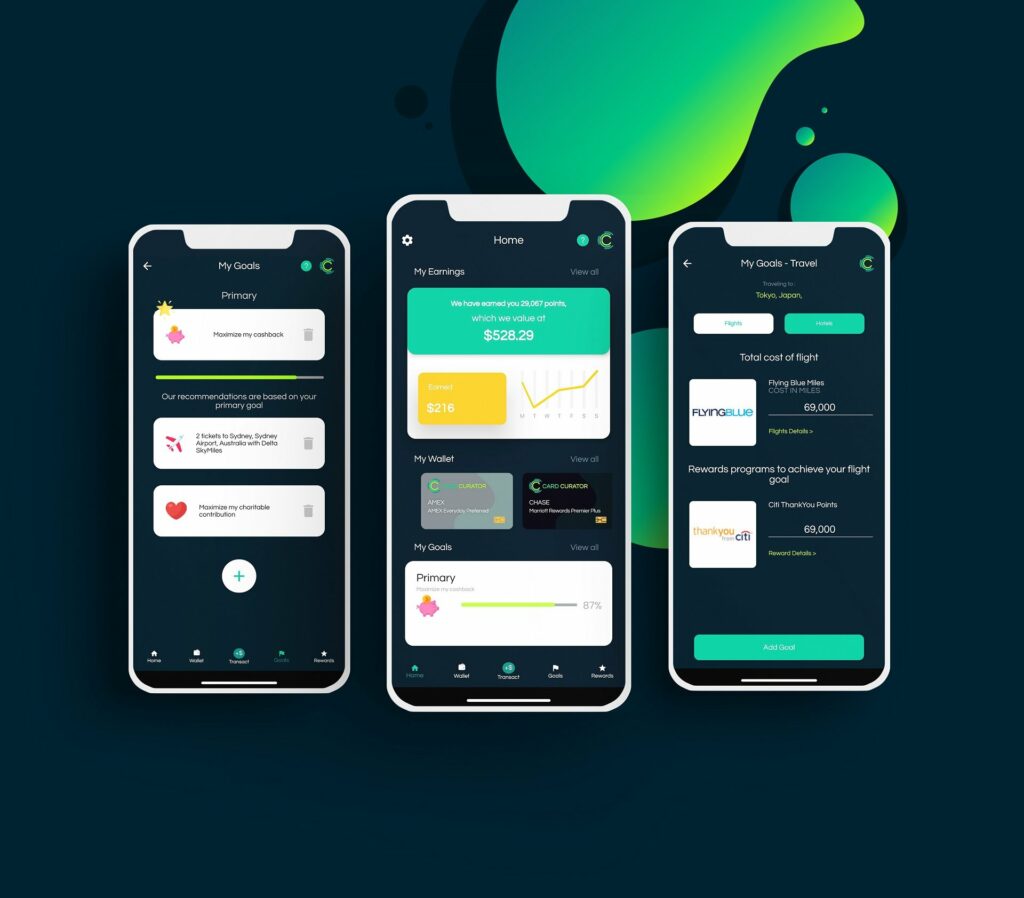

With Card Curator, you can manually set a travel or financial goal for yourself, and track your progress toward achieving the goal. The app will also make automatic recommendations for a credit card to help you reach your goals. Card Curator even recommends the best card for every purchase based on the cards in your wallet and the type of purchase. In addition to tracking progress toward a specific goal, Card Curator also keeps track of all your rewards programs.

Their algorithm, CardArb™, automatically recommends which credit cards to apply for (and it’s not paid per card sale like many apps are, so this is unbiased), downgrade or cancel based on a user’s primary goal and spending habits. It also gives recommendations to users on the best way to combine or transfer points, which further maximizes their reward value and minimizes the need to apply for new cards.

Card Curator also allows users to track their sign-up bonuses, and will also notify them on what is needed to meet their minimum spend in the designated time frame.

Cost

The Card Curator app is free to download and use. However, there are two versions of the app: Free and Premium. Free is a simple credit card recommendation tool that recommends the credit cards in your wallet to use on every purchase, based on your geolocation. Moreover, this version also features a best possible card recommendation, which is the best credit card currently in the marketplace to help you earn optimal rewards according to the spending category.

On the other hand, Premium has the goal setting and personalized credit card recommendations features to help maximize rewards for return, giving, cash back, travel, flights, and hotels. Premium also offers two pricing options either $5.99 per month or $60 a year. New users can try out Premium for free and risk-free, with a 90-day trial.

Summary

There are several credit card tracking apps available right now, and each has different features. By finding the app that best meets your needs, you can make sure to earn the most possible rewards every time you use your credit card.

Who The App Is Best For

Card Curator is best for those who are goal-oriented. Tracking progress toward a travel or financial goal can be motivational for some users.

Best Aspects

The ability to set a travel or financial goal and track progress is fairly unique to this app.

Where To Find the App

The CardCurator app can be downloaded here, available for both Apple and Android.

Summary of Features

| UThrive | TravelFreely | MaxRewards | CardPointers | CardCurator | |

| New Card Recommendations | Yes | Yes | Yes | Yes | Yes |

| Sign-up Bonus SpendingTracking | Yes | No | Yes | No | Yes |

| Annual Fee Reminders | No | Yes | Yes | Yes | Yes |

| Card Rec. Based on Purchase | Yes | No | Yes | No | Yes |

Bottom Line

There are several credit card tracking apps available right now, and each has different features. By finding the app that best meets your needs, you can make sure to earn the most possible rewards every time you use your credit card.

Thoughts?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

![[Last Day for Old Pricing – March 25] Hyatt’s Yearly Category Changes Are Up Impression Isla Mujeres by Secrets](https://milestalk.com/wp-content/uploads/2023/12/SEIIM-P0007-Main-Pool.16x9.jpg-218x150.webp)