In this article

Chase Ultimate Rewards: How to Earn and Spend Them for Maximum Value

Originally written by Anna Zaks, MilesTalk Guest Contributor

Last Updated: June 23, 2025 by Dave Grossman

What are Chase Ultimate Rewards Points?

Chase Ultimate Rewards (URs) are credit card rewards points that can be earned with a variety of credit cards issues by Chase bank. They are some of the most valuable and most popular credit card rewards in the world of travel rewards. This is, in part, because of the simplicity of their transfer partners and most transfer partners supporting instant transfers, in addition to the ability to easily redeem them via the Chase Travel Portal. There are a few ways to earn them, and even more ways to redeem them for travel. Besides the signup bonuses, all Chase UR earning cards have bonus spending categories, such as 3X for travel and dining, or 5X for paying your phone and cable bill. Thanks to these bonus categories, it’s quite easy to accumulate a good stash of Rewards. Just a few new card bonuses alone can easily get you a starting balance of over 200,000. There are tons of great ways to use Chase UR’s for free travel. As mentioned earlier, Chase’s points are some of the easiest to redeem among the major bank’s “transferrable currencies.” They are flexible and easy to use because they can be transferred to a variety of travel partners. MilesTalk maintains a list of transfer partners and transfer times for all transferrable points. You can also use them to book travel through the Chase Travel Portal. Ultimate Rewards are many travelers’ favorite “currency”. Unlike airline miles or hotel programs, they offer many redemption options and don’t limit you to a specific hotel chain or an airline. And don’t call them “Ultimate Chase Rewards” or leave off the “s” like Chase Ultimate Reward – we want you to sound cool!

10 Best Ways to Use Chase Ultimate Rewards Points

There are so many great ways to use Chase points. Here is a “10 best ways to redeem Ultimate Rewards” to help ensure you get the maximum value when you use your points! There are, of course, many more possibilities!

1) Transfer to Singapore KrisFlyer and book Singapore Suites

If you’d like to experience luxury in the sky, transferring your points to

KrisFlyer to book Singapore Suites is a great option. You’ll need 148,500 KrisFlyer miles to fly from New York (JFK) to Singapore with a connection in Frankfurt (one way). A more “inexpensive” way to experience Singapore Suites is to fly from JFK to Frankfurt for 86,000 miles. If you’d really like to stretch your luxury experience, 188,000 KrisFlyer miles can get you New York City to Sydney, Australia with connections in Frankfurt and Singapore. To experience Singapore’s famous business class for less, watch out for Singapore Spontaneous Escapes. You can save up to 30% of KrisFlyer miles on select routes. Here’s a review of that Singapore First Class Suite. Singapore has also introduced a newer Singapore Airlines First Class Suite which Dave reviewed in 2022 at a cost of 86,000 KrisFlyer miles and EUR €118.

2) Transfer to Flying Blue and Book Promo Awards

The combined Air France/KLM loyalty program Flying Blue doesn’t have an award chart. On the 1st of each month, Flying Blue releases promo award tickets up to 50%. The travel can be booked up to 3 months ahead. We’ve seen some real gems, like travel between North American and Europe in business class for 25-50% off. As a Skyteam partner, this is a “backdoor” way to use Chase points to book Delta flights.

3) Transfer to United Airlines MileagePlus

Even with the most recent changes to United MileagePlus program, transferring Ultimate Rewards to United is a solid option. The best value will come from booking business class on Star Alliance partners. For example, you can fly to Europe on Austrian Airlines or on Swiss for 88,000 United miles one way. United doesn’t pass on fuel surcharges, so you’ll just have to pay taxes, which are minimal.

4) Transfer to Virgin Atlantic Flying Club

Virgin Atlantic’s award chart for its own flight isn’t particularly attractive and the fuel surcharges are very high. However, this program really shines when it comes to Virgin Atlantic partner award bookings. You can sometimes find award space on Delta flights for fewer miles than with Delta’s own program. And not just a little less. Another great way to redeem Virgin Atlantic miles is to book an ANA Business or First class award:

- First Class to/from Japan from West Coast: 145,000 points Round Trip

- First Class to/from Japan from East Coast: 170,000 points Round Trip

- Business Class to/from Japan from West Coast: 105,000 points Round Trip

- Business Class to/from Japan from East Coast: 120,000 points Round Trip

Select new routes from New York / JFK even feature their new Suites.

5) Transfer to Iberia Avios

Iberia’s award chart has peak and off-peak award rates. The off-peak dates actually include great months/weeks during the shoulder season. You can fly one-way to Spain in business class for just 40,500 Iberia Avios during off-peak times from the East Coast. The so-called shoulder season is the perfect time to visit Spain, and you can’t go wrong with a transatlantic flight in business class for just 40,500 Avios. Iberia has been onboarding a new business class suites product on select flights, offering more privacy.

Just don;t book non-Iberia flights via Iberia as they will be non-cancellable!

6) Transfer to British Airways Avios

British Airways Avios are very useful when you need to book short nonstop flights. British Airways Avios also come in handy when you need to book American Airlines flights but don’t have any AA miles. These can also be further transferred to Qatar, which now uses Avios, to book the famous QSuites. In a recent positive turn of events (2024) you can transfer to Finnair Avios and book domestic AA flights by phone or chatbot. In fact, as of April 21, 2025, it was possible to book 3-Cabin First Class on the AA transcon (New York to SFO or LAX) for just 30,000 Finnair Avios – IF you can find saver availability which is admittedly rare.

7) Transfer to Aer Lingus Avios

Ireland’s flagship carrier has a zone-based award chart. You can get to Ireland for just 13,000 miles off-peak for a one way flight in economy from a few major U.S. gateway airports. Business class is just 50,000 miles off-peak. Aer Lingus also has a new direct Minneapolis to Dublin route. This is a great way for someone in the Midwest to get across the pond.

8) Transfer to Southwest Rapid Rewards

Southwest has a great network in the lower 48 states, it flies to the Caribbean and Mexico and it recently added flights to Hawaii from the West coast. Southwest often runs great fare sales when you can snag tickets for about 6,000 Rapid Rewards miles. By transferring UR points to Southwest, you can get award tickets for the entire family without breaking the bank. Note, though, that since Southwest awards are dynamically priced based on the cash fare, these won’t be the “best use” of your Ultimate Rewards. And in 2025 devaluations, the value of Rapid Rewards points has been greatly diminished at the same time the airline is going to start charging for checked bags and extra legroom seats. This is no longer one of our recommended uses for Chase Ultimate Rewards points. Transferred points won’t count towards Companion Pass but we do have the ultimate guide to earning a Southwest Companion Pass for two years here.

9) Transfer Ultimate Rewards to Hyatt

Ultimate Rewards’ best hotel partner, Hyatt, has a great award chart with plenty of sweet spots. This is Dave’s favorite way to use your points. Unfortunately, with SLH’s partnership ended (they are now partnered with Hilton), it’s harder to find amazing awards with Hyatt, but they still exist! Hyatt also has a ton of all-inclusive resorts in Mexico and the Caribbean. This is a great bargain – all meals, drinks and lots of activities are included for a true worry-free vacation. And you can also book Hyatt Suites online for double the points or less – making Hyatt an ideal program for families,

10) Redeem directly through the Chase Travel℠ Portal

If you have the Chase Sapphire Reserve® card or Chase Sapphire Reserve for Business℠ and plan to book travel through Chase travel portal, you’ll get the maximum value out of your Rewards with a premium Points Boost with a maximum value of 2 cents per point on select flights and hotel bookings – and 1 cent per point on other bookings..

If you have the Chase Sapphire Preferred or Chase Ink Business Preferred cards, Points Boost is worth between 1.5 and 1.75 cents per point on eligible air and hotel Points Boost bookings – or 1 cent per point on other bookings.

How Do You Earn Chase Ultimate Rewards Points?

(If you want, you can skip straight to: How to Transfer Ultimate Rewards Points to Travel Partners) You can earn them with a variety of personal and business credit cards.

Chase Sapphire Reserve

The current bonus is 125,000 Chase Ultimate Rewards points plus a $500 Chase Travel℠ credit after you spend $6,000 on purchases in the first three months from account opening. The annual fee is $795; $175 for each authorized user.

- 8X points on all Chase Travel℠ purchases

- 4X points on flights and hotels booked direct

- 3X points on dining

- 5X points on Lyft rides through 9/30/27

- 1X points on everything else

(See our card details page for the complete list of benefits.)

Chase Sapphire Preferred

The current bonus is 75,000 bonus points after you spend $5,000 on purchases in the first three months from account opening.

The annual fee is $95.

Benefits:

- 3X points on dining

- 2X points on travel (5X if booked through the Chase Travel Portal)

- 3X points on select streaming services and with online grocery delivery services

Chase Sapphire Preferred - 1X on all other purchases

- 5X on Lyft rides through September 30, 2027

- Points can be redeemed through the Chase Travel portal

- $50 annual travel credit

- 10% bonus on all base points earned in the previous cardmember year on your anniversary

- Primary car rental coverage (secondary in New York), trip interruption/cancellation insurance and other trip interruption benefits

- You and your authorized user(s) will receive at least 12 months of complimentary DashPass for use on both the DoorDash and Caviar applications during the same membership period based on the first activation date, when the membership is activated with a Chase Sapphire Preferred card by December 31, 2027.

- Points can be transferred to multiple airline and hotel partners and don’t expire as long as your account is open

- Application rules: You must be under 5/24. Other factors may affect eligibility and you will be given a chance to accept the card without the bonus if ineligible. If this happens, there would be no effect on your credit.

Chase Freedom Flex

$200 (20,000 Ultimate Rewards points) when you spend $500 in your first 3 months.

- 5X on travel when purchased through the Chase Ultimate Rewards portal*

- 5X on rotating quarterly bonus categories (max of $1,500 per quarter in spend; activation required – same as existing Freedom card)

- 2X on Lyft until September 30, 2027

- 3X on dining (including takeout and delivery)

- 3X at drugstores

- 1X on everything else

Read our review of the Chase Freedom Flex card.

Chase Freedom Unlimited

Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening

- 5X on travel when purchased through the Chase Ultimate Rewards portal*

- 2X on Lyft until September 30, 2027

- 3X on dining (including takeout and delivery)

- 3X at drugstores

- 1.5X on everything else

* Note the downsides: If you book air via the portal, you have to deal with Chase rather than the airline on changes or cancellations. If you book hotels, they are prepaid bookings ineligible for elite night credits, hotel points earning, or hotel elite benefits, if applicable. These points are only transferable to Ultimate Rewards transfer partners if you also hold a Sapphire Reserve, Sapphire Preferred, or Chase Ink Business Preferred credit card. Else they are like cash back and worth a penny per point.

Compare the Chase Freedom Flex and the Chase Freedom Unlimited.

Chase Ink Business Preferred

The current bonus is 90,000 points after you spend $8,000 on purchases in the first

- 3X points on the first $150,000 spent in combined purchases on travel, shipping purchases, internet, cable and phone services, advertising made with social media sites and search engines each year

- 1X on all other purchases

- 5X bonus points on Lyft rides

- The points can be redeemed through the Chase Travel portal. These points are also transferable to Ultimate Rewards transfer partners if you also hold a Sapphire Reserve, Sapphire Preferred, or Chase Ink Business Preferred credit card and move the points over to that card.

Chase Ink Business Cash

Offer:

Earn $900 when you spend $6,000 on purchases in the first three months after account opening.

This is awarded as 90,000 Ultimate Rewards Points, transferrable if you also hold a Sapphire Preferred®, Sapphire Reserve®, Ink Business Preferred®, or Sapphire Reserve for Business℠.

No annual fee.

Benefits:

- Earn 5X on the first $25,000 in combined purchases at

office supply stores and on internet, cable and phone services each account anniversary year. There are a lot of things you can buy at Staples, etc, so this is 5X on more than you think when you first hear office supplies!

- Earn 2X on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year

- Points don’t expire as long as your account is open

These points are only transferable to Ultimate Rewards transfer partners if you also hold a Sapphire Reserve, Sapphire Preferred, or Chase Ink Business Preferred credit card.

Chase Ink Business Unlimited

Earn $900 when you spend $6,000 on purchases in the first three months after account opening.

This is awarded as 90,000 Ultimate Rewards Points, transferrable if you also hold a Sapphire Preferred®, Sapphire Reserve®, Ink Business Preferred®, or Sapphire Reserve for Business℠.

No annual fee.

Benefits:

- Earn unlimited 1.5% cash back reward on every purchase

- Points don’t expire as long as your account is open

These points are only transferable to Ultimate Rewards transfer partners if you also hold a Sapphire Reserve, Sapphire Preferred, or Chase Ink Business Preferred credit card. You can also use the rewards maximizer tool at Your Best Credit Cards to see which of these cards best matches your spending habits.

Chase Ink Business Premier

Current Bonus: Earn $1,000 bonus cash back after you spend $10,000 on purchases in your first 3 months from account opening. Benefits:

- Earn unlimited 2% cash back reward on every purchase

- Earn 2.5% cash back on purchases of $5,000 or more.

- Points don’t expire as long as your account is open

These points are NOT transferable. They are cash back only. Please see this article that clarifies how Chase Ink Business Premier “points” are pure Cash Back and cannot be transferred.

Chase Reconsideration Line

If you don’t get an instant approval for your Chase credit card, or get flat-out declined, you may want to call the Chase reconsideration line.

How Can Cash Back Really Mean Ultimate Rewards Points?

You might be wondering why the cash back cards are included here. Even cash back cards earn Ultimate Rewards from Chase, however, (as I’ve tried to notate beside each cash back card above) unless you have a premium card, which means a Chase Rewards earning card with an annual fee, they can only be redeemed as statement credits. You need a Chase Sapphire Reserve, Chase Sapphire Preferred, or Chase Ink Business Preferred to transfer the Ultimate Rewards from the no annual fee cards (Freedom Flex, Freedom Unlimited, Ink Cash, Ink Unlimited) to – then those become fully transferrable points instead of cash back. The Chase Freedom, Freedom Unlimited, Ink Cash and Ink Business Unlimited are all great cards and could be very useful when you are trying to accumulate a good amount of points. For example, you can maximize your spending with the 5% cash back rotating categories on Freedom card, then transfer to Sapphire Reserve to book travel.

One note: Dave advises not opening more than one Chase card every 32 days, and you should also familiarize yourself with the Chase 5/24 rule which prevents you from getting any Chase cards if you have opened 5 personal cards with ANY issuer in the last 24 months.

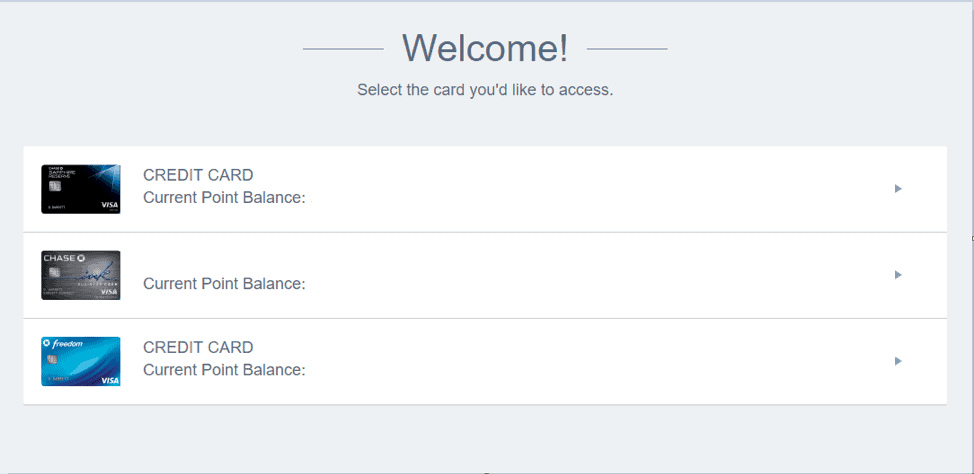

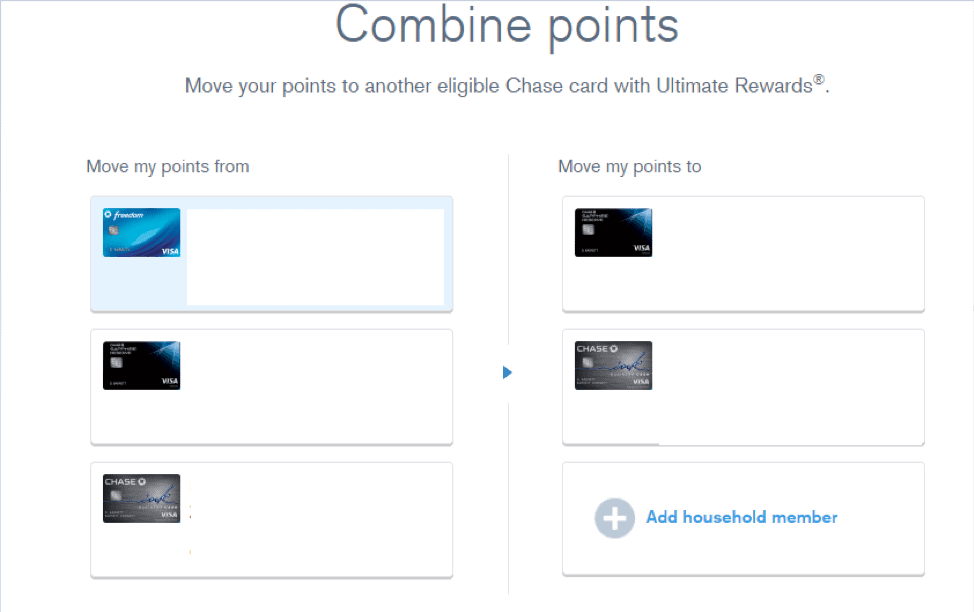

How Do You Combine Points from Different Chase Ultimate Rewards Accounts?

It’s very easy to combine points earned with different cards, even business to personal. If you have more than one personal Chase card, all the cards will show up under the same login. However, if you have personal and business cards, by default, you’ll have two separate logins. To combine the personal and the business logins, you’ll have to call Chase.

If you have the Chase Sapphire Reserve® card or Chase Sapphire Reserve for Business℠ and plan to book travel through Chase travel portal, you’ll get the maximum value out of your Rewards with a premium Points Boost with a maximum value of 2 cents per point on select flights and hotel bookings – and 1 cent per point on other bookings..

If you have the Chase Sapphire Preferred or Ink Preferred cards, Points Boost is worth between 1.5 and 1.75 cents per point on eligible air and hotel Points Boost bookings – or 1 cent per point on other bookings.

URs earned with the Chase Sapphire Reserve, Chase Sapphire Reserve for Business℠, Chase Sapphire Preferred, and Chase Ink Business Preferred can be transferred to transfer partners.

So if you have points earned with any of the cash back cards, combine them with points earned with one of these three cards to get the best value. Notably, the Chase Ink Business Premier card describes the points earned as Ultimate Rewards, however, they cannot be transferred to other cards nor to transfer partners – so that card is an exception as the points earned are worth just a penny eacy You can also combine points with a household member. Both cardholders have to have the same address. For example, if another household member has Sapphire Reserve and you have a Freedom card, transfer your points to them.

Note: Do not play games and try to game the system to transfer to non-family members. This is likely to cause a shutdown of your accounts. To combine, log into your Ultimate Rewards account and you’ll see a screen that looks like this:

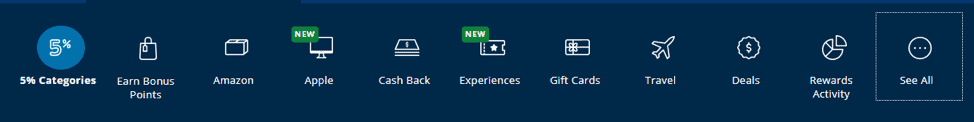

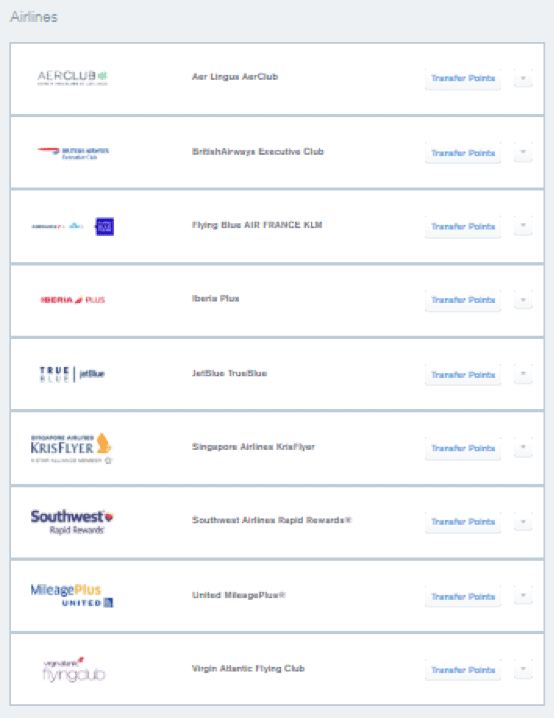

How Do You Transfer Ultimate Rewards Points to Travel Partners?

Transferring your points to partners is equally easy. You’ll need to create an airline frequent flier account and an account with the hotel loyalty program. Keep in mind that transfers are one way and are final. Once you move the points to an airline or hotel, you can’t get them back. Check and recheck award availability before you move the points. The points transfer in 1,000 point increments. If you don’t have enough in one account, this is where combining points from different account can really help you get just enough rewards for that perfect redemption.

Here’s how to transfer points to a travel partner:

Log into your Ultimate Rewards account and click Transfer to Travel Partners.

Chase Ultimate Rewards Transfer Partners and Transfer Times

| Chase Ultimate Rewards Transfer Partners | Last Updated: August 2025 | |

|---|---|---|

| Transfer Ratio | Expected Transfer Time * | |

| Aer Lingus Avios | 1:1 | Instant |

| Air Canada Aeroplan | 1:1 | Instant |

| Air France Flying Blue | 1:1 | Instant |

| British Airways Avios | 1:1 | Instant |

| Emirates (Transfers End Oct 15, 2025) | 1:1 | Instant |

| Iberia Avios | 1:1 | Instant |

| JetBlue | 1:1 | Instant |

| Singapore Airlines KrisFlyer | 1:1 | ~ 1 - 2 days |

| Southwest Airlines | 1:1 | Instant |

| United MileagePlus | 1:1 | Instant (usually - some have reported delays) |

| Virgin Atlantic Flying Club | 1:1 | Instant |

| Hyatt | 1:1 | Instant |

| Marriott Bonvoy | 1:1 | ~ 1-2 days |

| IHG Rewards Club | 1:1 | ~ 24 hours |

Transfer Partners (Airline):

- Aer Lingus AerClub (instant transfer)

- Air France/KLM Flying Blue (instant transfer)

- Air Canada Aeroplan (instant transfer)

- British Airways Avios (instant transfer)

- Emirates (instant transfer)

- Iberia Plus (instant transfer)

- JetBlue TrueBlue (instant transfer)

- Singapore Airlines KrisFlyer (1-2 days)

- Southwest Airlines Rapid Rewards (instant transfer)

- United Airlines MileagePlus (instant transfer)

- Virgin Atlantic Flying Club (instant transfer)

While there are only nine airline transfer partners, it doesn’t mean you have to fly on one

of them. That’s where knowing airline alliances and partnerships comes in handy. For example, you can use Virgin Atlantic Flying Club miles to book Delta flights, or British Airways miles to book flights on American Airlines. This is just another reason why URs are so valuable. One of the best things about the MilesTalk Facebook group is that it’s a great place to get nearly instant help on doing what I’m talking about here.

Transfer Partners (Hotels):

- World of Hyatt (instant transfer)

- IHG Rewards Club (about 24 hours)

- Marriott Bonvoy (1-2 days)

For hotel stays, you’ll get the best value by transferring them to Hyatt. It’s usually not a great idea to transfer to Marriott and IHG because award stays require a large number of points. UR points transfer at a 1:1 rate to all airline and hotel partners. Remember that even though all three hotel partners have 1:1 transfer ratios, they aren’t worth the same amount, with Hyatt points worth close to 4x the value of IHG, despite the same transfer ratio.

Pay Yourself Back

In 2020, in response to the COVID-19 pandemic, Chase introduced a new way to redeem points at the full value of your card. After making purchases at select and rotating categories, you can “Pay Yourself Back” based on the Travel Portal value of your points. This varies every so often in terms of what categories can be paid back and at exactly what rate. While airline transfers generally offer the most total value, some do prefer to redeem via both the Travel Portal and Pay Yourself Back for simplicity.

Value of Chase Ultimate Rewards Points

MilesTalk values Chase Ultimate Rewards points at 1.75 cents each. This isn’t a minimum or guaranteed value when you use your points but, given the ways we’ll mention in the next section, you’ll find that if you are patient about when you redeem them it is easy to get 2 cents or more in value per point.

Chase Ultimate Rewards Program Travel Portal Login

You can login to the Chase Ultimate Rewards travel portal here. Related Posts:

- Choosing a Chase Ink Business Credit Card

- Chase Transfer Partners and Transfer Times for Ultimate Rewards [2025]

- Chase Trifecta: Three credit cards that maximize Chase Ultimate Rewards Points

- Chase Reconsideration Line: How It Works

- How to Combine your Ultimate Rewards points

- Chase Ink Business Premier “points” are pure Cash Back and cannot be transferred.

- Chase Freedom Flex vs. Chase Freedom Unlimited: What’s the Difference?

- Chase Freedom Flex vs. Chase Freedom: All of Your Questions Answered

- Where can I transfer Chase, Citi, American Express, Capital One and Marriott points?

- A point is not equal to a point… or a mile

- What is a Mile or Point Worth?

Final Thoughts

The Chase Ultimate Rewards program is a fantastic one, with points that are fairly easy to earn thanks to the number of Chase credit cards that come with generous welcome bonuses and great bonus spending categories. As you can see, there are many great ways to use these valuable points. We love Ultimate Rewards for their flexibility and versatility. Don’t be tempted to cash out your UR points for gift cards or statement credits. The value is much greater when the points are transferred to the travel partners or used to book travel through the portal. With some planning, you’ll soon be traveling in business class to Europe or jetting off to Hawaii for free!

Was this Chase Ultimate Rewards Points guide helpful?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

FAQ

What are Chase Ultimate Rewards points and how can I earn them?

Chase Ultimate Rewards points are a rewards currency that can be earned through various Chase credit cards. You can earn points by making purchases with your card, participating in special promotions, and using Chase’s travel partners. Points can be redeemed for travel, gift cards, cash back, and more.

office supply stores and on internet, cable and phone services each account anniversary year. There are a lot of things you can buy at Staples, etc, so this is 5X on more than you think when you first hear office supplies!

office supply stores and on internet, cable and phone services each account anniversary year. There are a lot of things you can buy at Staples, etc, so this is 5X on more than you think when you first hear office supplies!

![[Ends Monday, October 27, 2025] Huge New Southwest Business Card Offer… southwest companion pass](https://milestalk.com/wp-content/uploads/2020/09/southwest-plane-218x150.jpg)

![Amazon “Pay One Point” Deal Links (Compilation) [UPDATED] amazon pay one point pay 1 point links amex chase citi discover](https://milestalk.com/wp-content/uploads/2023/11/payonepoint-218x150.png)

![[Offer Extended to 10/15/25] New Mesa Card Offer for 50,000 Points mesa 50,000 point offer](https://milestalk.com/wp-content/uploads/2025/09/66c3c5d5b59658ca588e1768_product_homeowners-card-218x150.jpg)

” it may make more sense to book Southwest flights using the Chase Travel Portal and earn Southwest miles”. Seems that the expedia powered Chase Travel Portal can’t book Southwest flights. Anything wrong?

You are right! I totally forgot and I even blogged about it 😉 https://milestalk.com/is-chase-ur-portal-losing-option-to-book-spirit-allegiant-and-southwest/ I’ll fix that now!

[…] Chase Ultimate Rewards Points: How to Earn and Redeem with Transfer Partners [Comprehensive Guide] […]

[…] Chase Ultimate Rewards Points: How to Earn and Redeem with Transfer Partners [Comprehensive Guide] […]

[…] Chase Ultimate Rewards Points: How to Earn and Redeem with Transfer Partners [Comprehensive Guide] […]

[…] Chase Ultimate Rewards Points: How to Earn and Redeem with Transfer Partners [Comprehensive Guide] […]

[…] Chase Ultimate Rewards Points: How to Earn and Redeem with Transfer Partners [Comprehensive Guide] […]

[…] Chase Ultimate Rewards Points: How to Earn and Redeem with Transfer Partners [Comprehensive Guide] […]