Last Updated: January 2, 2023

In this article

Chase Ultimate Rewards: How to Earn and Spend Them for Maximum Value

Originally written by Anna Zaks, MilesTalk Guest Contributor

Last Updated: Jan 2, 2023 by Dave Grossman

What are Chase Ultimate Rewards Points?

Chase Ultimate Rewards (URs) are credit card rewards points that can be earned with a variety of credit cards issues by Chase bank.

They are some of the most valuable and most popular credit card rewards in the world of travel rewards. This is, in part, because of the simplicity of their transfer partners and most transfer partners supporting instant transfers, in addition to the ability to easily redeem them via the Chase Travel Portal.

There are a few ways to earn them, and even more ways to redeem them for travel. Besides the signup bonuses, all Chase UR earning cards have bonus spending categories, such as 3X for travel and dining, or 5X for paying your phone and cable bill. Thanks to these bonus categories, it’s quite easy to accumulate a good stash of Rewards. Just a few new card bonuses alone can easily get you a starting balance of over 200,000.

There are tons of great ways to use Chase UR’s for free travel. As mentioned earlier, Chase’s points are some of the easiest to redeem among the major bank’s “transferrable currencies.” They are flexible and easy to use because they can be transferred to a variety of travel partners. MilesTalk maintains a list of transfer partners and transfer times for all transferrable points. You can also use them to book travel through the Chase Travel Portal.

Ultimate Rewards are many travelers’ favorite “currency”. Unlike airline miles or hotel programs, they offer many redemption options and don’t limit you to a specific hotel chain or an airline.

And don’t call them “Ultimate Chase Rewards” or leave off the “s” like Chase Ultimate Reward – we want you to sound cool!

10 Best Ways to Use Chase Ultimate Rewards Points

There are so many great ways to use Chase points.

Here is a “10 best ways to redeem Ultimate Rewards” to help ensure you get the maximum value when you use your points! There are, of course, many more possibilities!

1) Transfer to Singapore KrisFlyer and book Singapore Suites

If you’d like to experience luxury in the sky, transferring your points to

KrisFlyer to book Singapore Suites is a great option. You’ll need 148,500 KrisFlyer miles to fly from New York (JFK) to Singapore with a connection in Frankfurt (one way).

A more “inexpensive” way to experience Singapore Suites is to fly from JFK to Frankfurt for 97,000 miles. If you’d really like to stretch your luxury experience, 188,000 KrisFlyer miles can get you New York City to Sydney, Australia with connections in Frankfurt and Singapore.

To experience Singapore’s famous business class for less, watch out for Singapore Spontaneous Escapes. You can save up to 30% of KrisFlyer miles on select routes.

Here’s a review of that Singapore First Class Suite.

2) Transfer to Flying Blue and Book Promo Awards

The combined Air France/KLM loyalty program Flying Blue doesn’t have an award chart. On the 1st of each month, Flying Blue releases promo award tickets up to 50%. The travel can be booked up to 3 months ahead.

We’ve seen some real gems, like travel between North American and Europe in business class for 25-50% off.

As a Skyteam partner, this is a “backdoor” way to use Chase points to book Delta flights.

3) Transfer to United Airlines MileagePlus

Even with the most recent changes to United MileagePlus program, transferring Ultimate Rewards to United is a solid option. The best value will come from booking business class on Star Alliance partners. For example, you can fly to Europe on Austrian Airlines or on Swiss for 70,000 United miles one way. United doesn’t pass on fuel surcharges, so you’ll just have to pay taxes, which are minimal. Add on an excursionist perk to add more value.

4) Transfer to Virgin Atlantic Flying Club

Virgin Atlantic’s award chart for its own flight isn’t particularly attractive and the fuel surcharges are very high. However, this program really shines when it comes to Virgin Atlantic partner award bookings. You can sometimes find award space on Delta flights for fewer miles than with Delta’s own program. And not just a little less. More like half price! While this used to apply to all Delta flights, a January 1, 2021 program change has limited this to US-Europe flights. However, that still means a flight like JFK-AMS is just 50,000 Virgin points each way.

Another great way to redeem Virgin Atlantic miles is to book an ANA Business or First class award. You’ll need just 95,000 miles for a roundtrip in business class on ANA from the US to Japan and 120,000 miles for first class roundtrip. If flying from the West coast, you’ll need just 90,000 miles for business class and 120,000 for first roundtrip.

Select new routes from New York / JFK even feature their new Suites.

5) Transfer to Iberia Avios

Iberia’s award chart has peak and off-peak award rates. The off-peak dates actually include great months/weeks during the shoulder season. You can fly one-way to Spain in business class for just 34,000 Iberia Avios during off-peak times from the East Coast. The so-called shoulder season is the perfect time to visit Spain, and you can’t go wrong with a transatlantic flight in business class for just 34,000 Avios. Iberia has been onboarding a new business class suites product on select flights, offering more privacy.

6) Transfer to British Airways Avios

British Airways Avios are very useful when you need to book short nonstop flights. You can book a domestic nonstop flights under 1150 miles operated by American Airlines or Alaska Airlines for 7,500 Avios. Sometimes, these short, nonstop flights cost as much as a transcontinental flight, so this could be a great redemption.

Flights from the West coast to Hawaii on American and Alaska will only set you back 12,500 Avios each way in economy.

British Airways Avios also come in handy when you need to book American Airlines flights but don’t have any AA miles.

Outside of the U.S., flights that are 650 miles or shorter will only cost 4,000 Avios off-peak and 4,500 Avios during the peak dates. That can be crazy good value for your URs.

These can also be further transferred to Qatar, which now uses Avios, to book the famous QSuites

7) Transfer to Aer Lingus Avios

Ireland’s flagship carrier has a zone-based award chart. You can get to Ireland for just 13,000 miles off-peak for a one way flight in economy from a few major U.S. gateway airports. Business class is just 50,000 miles off-peak.

Aer Lingus also has a new direct Minneapolis to Dublin route. This is a great way for someone in the Midwest to get across the pond.

8) Transfer to Southwest Rapid Rewards

Southwest has a great network in the lower 48 states, it flies to the Caribbean and Mexico and it recently added flights to Hawaii from the West coast. Southwest often runs great fare sales when you can snag tickets for about 6,000 Rapid Rewards miles.

By transferring UR points to Southwest, you can get award tickets for the entire family without breaking the bank. Don’t forget that Southwest allows two free checked bags, a great benefit in the age of restrictive basic economy fares. This is a great perk when traveling with a family or if you need to check skies, snowboards or other bulky equipment.

Note, though, that since Southwest awards are dynamically priced based on the cash fare, these won’t be the “best use” of your Ultimate Rewards.

Transferred points won’t count towards Companion Pass but we do have the ultimate guide to earning a Southwest Companion Pass for two years here.

9) Transfer Ultimate Rewards to Hyatt

Ultimate Rewards’ best hotel partner, Hyatt, has a great award chart with plenty of sweet spots. Hyatt recently partnered with Small Luxury Hotels and Thompson Hotels to offer its members even more options for earning and redeeming points. This is Dave’s favorite way to use your points.

Hyatt also has a ton of all-inclusive resorts in Mexico and the Caribbean. This is a great bargain – all meals, drinks and lots of activities are included for a true worry-free vacation. And you can also book Hyatt Suites online for double the points or less!

10) Redeem directly through the Chase Travel Portal

It’s very easy to book travel through the Chase Travel Portal. If you have the Chase Sapphire Reserve, the points are worth 1.5c per point. If you have the Sapphire Preferred or Ink Business Preferred, the points are worth 1.25c per point.

Sometimes, when the cash price of an airline ticket is low, it makes sense to book it through the portal, rather than transfer points to a partner. Flights booked on the portal earn redeemable and elite qualifying miles and there are no blackout dates. So if you need flights on certain dates, and your schedule isn’t flexible, booking through the portal is an excellent option, even if it isn’t the best possibly redemption in terms of absolute value for points.

The portal also has a good selection of hotels – you can find many great non-chain or boutique hotels. A word of caution, however: hotel bookings made through the portal don’t earn loyalty points or qualifying nights. If you have elite status, it might not be recognized.

How Do You Earn Chase Ultimate Rewards Points?

(If you want, you can skip straight to: How to Transfer Ultimate Rewards Points to Travel Partners)

You can earn them with a variety of personal and business credit cards.

Chase Sapphire Reserve

The current bonus is 60,000 Chase Ultimate Rewards after you spend $4,000 on purchases in the first three months from account opening.

The annual fee is $550; $75 for each authorized user.

Benefits:

- 3X points on travel and dining (earn10X on airfare and hotels or5X on car rentals when booked via the Ultimate Rewards portal)

- 1X on all other purchases

- The points can be redeemed through the Chase travel portal at a rate of 1.5 cents per point

- $300 annual travel credit that can be used on a variety of purchases, such as airfare, hotels, toll fees, train travel, airline fees and more

- Earn 10X Rewards on Lyft rides through March 31, 2025

- Get a one-time complimentary Lyft Pink subscription (15% Lyft discounts, free bike/scooter rentals each month, and better cancellation rules). This is a $240 value.

- You and your authorized user(s) will receive at least 12 months of complimentary DashPass for use on both the DoorDash and Caviar applications during the same membership period based on the first activation date, when the membership is activated with a Chase Sapphire Preferred card by 12/31/2024. Also get $5 per month in DoorDash credit. Three months can accrue at a time for a maximum of $15 in credits if you use three month’s of credit at once.

- 1 year of complimentary Instacart+. Activate by July 31, 2024. Membership auto-renews. Plus, Instacart+ members earn up to $15 in statement credits each month through July 2024.

- $10 monthly statement credit from Gopuff. Promotion runs through December 2023.

- Global Entry or TSA PreCheck $100 fee reimbursement. You can use it to pay for your own, or someone else’s application

- Priority Pass Select lounge access. One of the most valuable benefits is the access to select airport lounges and participating restaurants

- Primary car rental coverage, trip interruption/cancellation insurance and other trip interruption benefits

- Points can be transferred to multiple airline and hotel partners and don’t expire as long as your account is open

- Application rules: You must be under 5/24 and have not gotten a bonus on this card in the last 48 months. You must also not have the card at the time you apply following the 48 month period.

Chase Sapphire Preferred

The current bonus is 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

The annual fee is $95.

Benefits:

- 3X points on dining

- 2X points on travel (5X if booked through the Chase Travel Portal)

- 3X points on select streaming services and with online grocery delivery services

- 1X on all other purchases

- 5X on Lyft rides through March 31, 2025

- Points can be redeemed through the Chase travel portal at a rate of 1.25 cents per point

- $50 annual travel credit

- 10% bonus on all base points earned in the previous cardmember year on your anniversary

- 6 months of complimentary Instacart+. Activate by July 31, 2024. Membership auto-renews. Plus, Instacart+ members earn up to $15 in statement credits each quarter through July 2024.

- $10 monthly statement credit from Gopuff. Promotion runs through December 2023.

- Primary car rental coverage, trip interruption/cancellation insurance and other trip interruption benefits

- You and your authorized user(s) will receive at least 12 months of complimentary DashPass for use on both the DoorDash and Caviar applications during the same membership period based on the first activation date, when the membership is activated with a Chase Sapphire Preferred card by 12/31/2024.

- Points can be transferred to multiple airline and hotel partners and don’t expire as long as your account is open

- Application rules: You must be under 5/24 and have not gotten a bonus on this card in the last 48 months. You must also not have the card at the time you apply following the 48 month period.

Chase Freedom Flex

$200 (20,000 Ultimate Rewards points) when you spend $500 in your first 3 months.

No fee. These points are only transferable to Ultimate Rewards transfer partners if you also hold a Sapphire Reserve, Sapphire Preferred, or Chase Ink Business Preferred credit card.

Benefits:

- 5X on travel when purchased through the Chase Ultimate Rewards portal*

- 5X on rotating quarterly bonus categories (max of $1,500 per quarter in spend; activation required – same as existing Freedom card)

- 5X on Lyft until March 2025

- 3X on dining (including takeout and delivery)

- 3X at drugstores

- 1X on everything else

+ World Elite Mastercard benefits

- Cell Phone Protection benefits for up to $800 per claim and $1,000 per year in cell phone protection against theft or damage for phones listed on cardmembers monthly bill. Maximum of 2 claims in a 12 month period with a $50 deductible per claim.

- A $10 credit for every 5 Lyft rides you take in a calendar month

- 5% back in Boxed rewards credits for future purchases

- Shoprunner (free 2 day shipping)

- Double VIP+ Fandango points when you get movie tickets through Fandango

Read our review of the Chase Freedom Flex card.

Chase Freedom Unlimited

The current new card welcome offer is to earn an additional 1.5% cash back on everything you buy (on up to $20,000) for your first year.

Benefits:

- 5X on travel when purchased through the Chase Ultimate Rewards portal*

- 5X on Lyft until March 2025

- 3X on dining (including takeout and delivery)

- 3X at drugstores

- 1.5X on everything else

* Note the downsides: If you book air via the portal, you have to deal with Chase rather than the airline on changes or cancellations. If you book hotels, they are prepaid bookings ineligible for elite night credits, hotel points earning, or hotel elite benefits, if applicable.

These points are only transferable to Ultimate Rewards transfer partners if you also hold a Sapphire Reserve, Sapphire Preferred, or Chase Ink Business Preferred credit card. Else they are like cash back and worth a penny per point.

Compare the Chase Freedom Flex and the Chase Freedom Unlimited.

Chase Ink Business Preferred

The current bonus is 100,000 points after you spend $15,000 on purchases in the first

Benefits:

- 3X points on the first $150,000 spent in combined purchases on travel, shipping purchases, internet, cable and phone services, advertising made with social media sites and search engines each year

- 1X on all other purchases

- 5X bonus points on Lyft rides

- The points can be redeemed through the Chase travel portal at a rate of 1.25 cents per point, can be transferred to multiple airline and hotel partners, and don’t expire as long as your account is open

Chase Ink Business Cash

$750 cash back (in the form of 75,000 Chase Ultimate Rewards points) after you spend $6,000 on purchases in the first three months from account opening. No fee.

Benefits:

- Earn 5X on the first $25,000 in combined purchases at

office supply stores and on internet, cable and phone services each account anniversary year. There are a lot of things you can buy at Staples, etc, so this is 5X on more than you think when you first hear office supplies!

- Earn 2X on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year

- Points don’t expire as long as your account is open

These points are only transferable to Ultimate Rewards transfer partners if you also hold a Sapphire Reserve, Sapphire Preferred, or Chase Ink Business Preferred credit card.

Related Article: Using the Chase Ink Business Cash credit card for 7.5% or more off of just about anything

Chase Ink Business Unlimited

Current Bonus: $750 cash back (in the form of 75,000 Chase Ultimate Rewards points) after

Benefits:

- Earn unlimited 1.5% cash back reward on every purchase

- Points don’t expire as long as your account is open

These points are only transferable to Ultimate Rewards transfer partners if you also hold a Sapphire Reserve, Sapphire Preferred, or Chase Ink Business Preferred credit card.

You can also use the rewards maximizer tool at Your Best Credit Cards to see which of these cards best matches your spending habits.

Chase Reconsideration Line

If you don’t get an instant approval for your Chase credit card, or get flat-out declined, you may want to call the Chase reconsideration line.

How Can Cash Back Really Mean Ultimate Rewards Points?

You might be wondering why the cash back cards are included here. Even cash back cards earn Ultimate Rewards from Chase, however, (as I’ve tried to notate beside each cash back card above) unless you have a premium card, which means a Chase Rewards earning card with an annual fee, they can only be redeemed as statement credits.

You need a Chase Sapphire Reserve, Chase Sapphire Preferred, or Chase Ink Business Preferred to transfer the Ultimate Rewards from the no annual fee cards (Freedom Flex, Freedom Unlimited, Ink Cash, Ink Unlimited)to – then those become fully transferrable points instead of cash back.

The Chase Freedom, Freedom Unlimited, Ink Cash and Ink Business Unlimited are all great cards and could be very useful when you are trying to accumulate a good amount of points. For example, you can maximize your spending with the 5% cash back rotating categories on Freedom card, then transfer to Sapphire Reserve to book travel.

One note: Dave advises not opening more than one Chase card every 32 days, and you should also familiarize yourself with the Chase 5/24 rule which prevents you from getting any Chase cards if you have opened 5 personal cards with ANY issuer in the last 24 months.

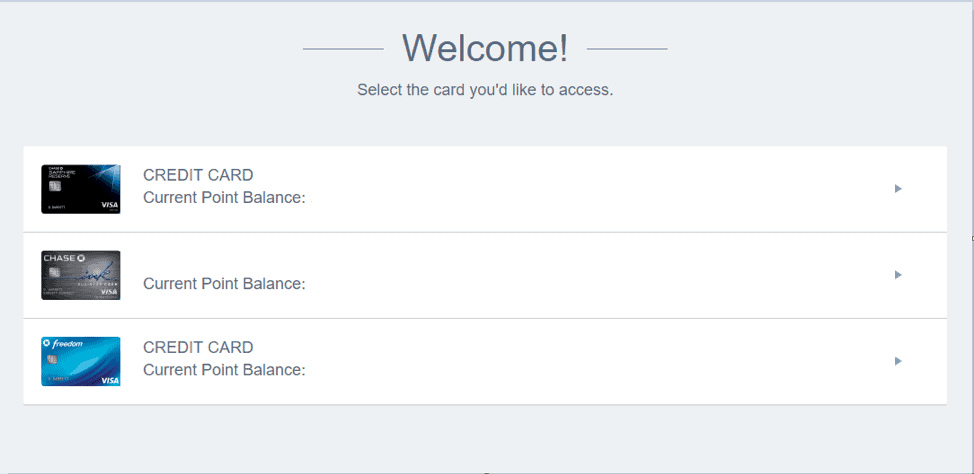

How Do You Combine Points from Different Chase Ultimate Rewards Accounts?

It’s very easy to combine points earned with different cards, even business to personal. If you have more than one personal Chase card, all the cards will show up under the same login. However, if you have personal and business cards, by default, you’ll have two separate logins. To combine the personal and the business logins, you’ll have to call Chase.

If you have the Chase Sapphire Reserve card and plan to book travel through Chase travel portal, you’ll get the maximum value out of your Rewards. The points are worth 1.5 cents each, so it would make sense to combine all your points under your Sapphire Reserve account.

If you have the Chase Sapphire Preferred or Ink Preferred cards, they are are worth 1.25 cents each when redeemed through the portal.

URs earned with the Chase Sapphire Reserve, Chase Sapphire Preferred, and Chase Ink Business Preferred can be transferred to transfer partners. So if you have points earned with any of the cash back cards, combine them with points earned with one of these three cards to get the best value.

Notably, the Chase Ink Business Premier card describes the points earned as Ultimate Rewards, however, they cannot be transferred to other cards nor to transfer partners – so that card is an exception as the points earned are worth just a penny eacy

You can also combine points with a household member. Both cardholders have to have the same address. For example, if another household member has Sapphire Reserve and you have a Freedom card, transfer your points to them.

Note: Do not play games and try to game the system to transfer to non-family members. This is likely to cause a shutdown of your accounts.

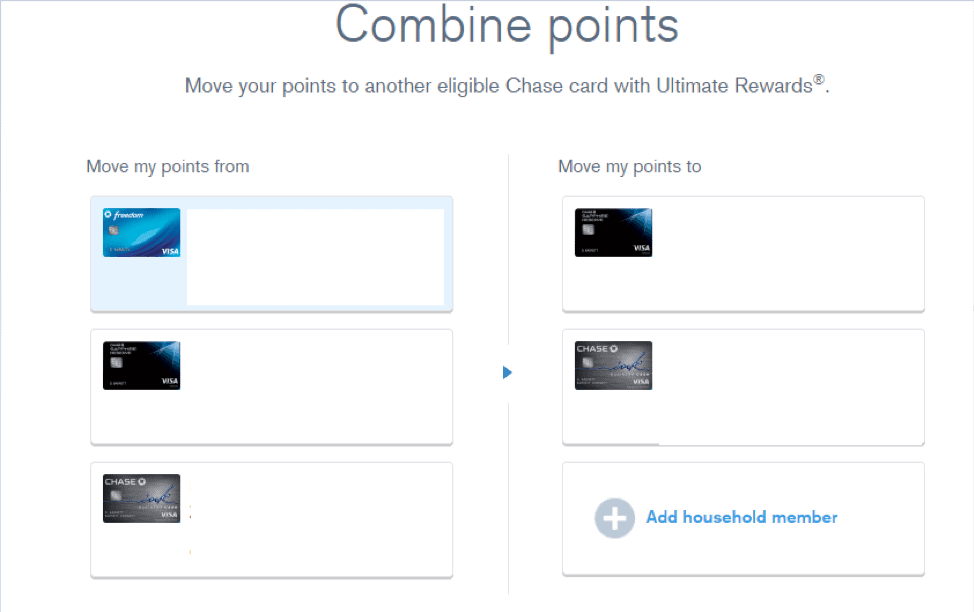

To combine, log into your Ultimate Rewards account and you’ll see a screen that looks like this:

Click on the card you’d like to transfer FROM, for example the Freedom card, and you’ll see this banner on the top.

Then click on See All on the right and the banner will expand to include the option to Combine Points.

Now click that and on the next screen choose to which card you want to transfer the points. You’ll also see an option to add a household member.

How Do You Transfer Ultimate Rewards Points to Travel Partners?

Transferring your points to partners is equally easy. You’ll need to create an airline frequent flier account and an account with the hotel loyalty program.

Keep in mind that transfers are one way and are final. Once you move the points to an airline or hotel, you can’t get them back. Check and recheck award availability before you move the points.

The points transfer in 1,000 point increments. If you don’t have enough in one account, this is where combining points from different account can really help you get just enough rewards for that perfect redemption.

Here’s how to transfer points to a travel partner:

Log into your Ultimate Rewards account and click Transfer to Travel Partners.

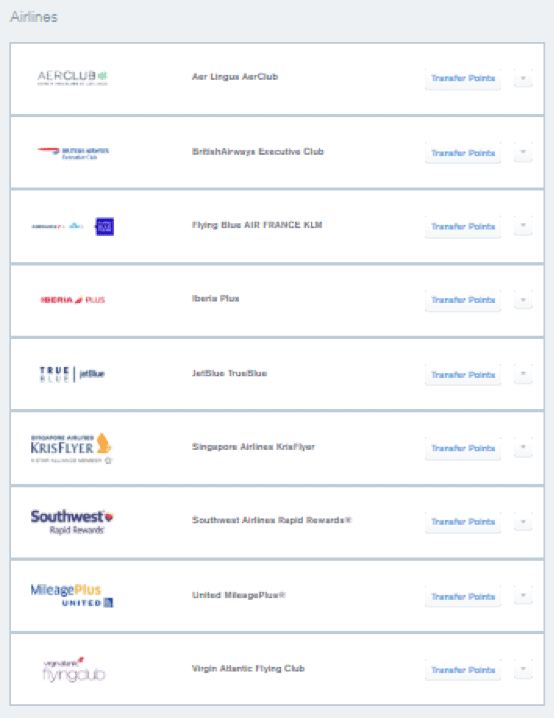

On the next screen you’ll see the list of all the transfer partners.

Chase Ultimate Rewards Transfer Partners and Transfer Times

| Chase Ultimate Rewards Transfer Partners | Last Updated: August 2021 | |

|---|---|---|

| Transfer Ratio | Expected Transfer Time * | |

| Aer Lingus Avios | 1:1 | Instant |

| Air Canada Aeroplan | 1:1 | Instant |

| Air France Flying Blue | 1:1 | Instant |

| British Airways Avios | 1:1 | Instant |

| Emirates | 1:1 | Instant |

| Iberia Avios | 1:1 | Instant |

| JetBlue | 1:1 | Instant |

| Singapore Airlines KrisFlyer | 1:1 | ~ 1 - 2 days |

| Southwest Airlines | 1:1 | Instant |

| United MileagePlus | 1:1 | Instant |

| Virgin Atlantic Flying Club | 1:1 | Instant |

| Hyatt | 1:1 | Instant |

| Marriott Bonvoy | 1:1 | ~ 1-2 days |

| IHG Rewards Club | 1:1 | ~ 24 hours |

Transfer Partners (Airline):

- Aer Lingus AerClub (instant transfer)

- Air France/KLM Flying Blue (instant transfer)

- Air Canada Aeroplan (starting sometime in 2021)

- British Airways Avios (instant transfer)

- Emirates (instant transfer)

- Iberia Plus (instant transfer)

- JetBlue TrueBlue (instant transfer)

- Singapore Airlines KrisFlyer (1-2 days)

- Southwest Airlines Rapid Rewards (instant transfer)

- United Airlines MileagePlus (instant transfer)

- Virgin Atlantic Flying Club (instant transfer)

While there are only nine airline transfer partners, it doesn’t mean you have to fly on one of them. That’s where knowing airline alliances and partnerships comes in

One of the best things about the MilesTalk Facebook group is that it’s a great place to get nearly instant help on doing what I’m talking about here.

Related Post: MilesTalk University: How to Use One Airline’s Miles to Fly Free on Another Airline

Transfer Partners (Hotels):

- IHG Rewards Club (about 24 hours)

- Marriott Bonvoy (1-2 days)

- World of Hyatt (instant transfer)

For hotel stays, you’ll get the best value by transferring them to Hyatt. It’s usually not a great idea to transfer to Marriott and IHG because award stays require a large number of points.

UR points transfer at a 1:1 rate to all airline and hotel partners.

Remember that even though all three hotel partners have 1:1 transfer ratios, they aren’t worth the same amount, with Hyatt points worth close to 4x the value of IHG, despite the same transfer ratio.

Pay Yourself Back

In 2020, in response to the COVID-19 pandemic, Chase introduced a new way to redeem points at the full value of your card. After making purchases at select and rotating categories, you can “Pay Yourself Back” based on the Travel Portal value of your points.

This varies every so often in terms of what categories can be paid back and at exactly what rate. In 2022, Sapphire Reserve categories dropped to a value of 1.25 cents per point for Pay Yourself Back while the Sapphire Preferred dropped to 1 cent per point (except for charitable donations).

While airline transfers generally offer the most total value, many do prefer to redeem via both the Travel Portal and Pay Yourself Back for simplicity.

Value of Chase Ultimate Rewards Points

MilesTalk values Chase Ultimate Rewards points at 1.75 cents each. This isn’t a minimum or guaranteed value when you use your points but, given the ways we’ll mention in the next section, you’ll find that if you are patient about when you redeem them it is easy to get 2 cents or more in value per point.

Chase Ultimate Rewards Program Travel Portal Login

You can login to the Chase Ultimate Rewards travel portal here.

Related Posts:

- Choosing a Chase Ink Business Credit Card

- Chase Transfer Partners and Transfer Times for Ultimate Rewards [2020]

- Chase Trifecta: Three credit cards that maximize Chase Ultimate Rewards Points

- Chase Reconsideration Line: How It Works

- How to Combine your Ultimate Rewards points

- Chase Freedom Flex vs. Chase Freedom Unlimited: What’s the Difference?

- Chase Freedom Flex vs. Chase Freedom: All of Your Questions Answered

- Where can I transfer Chase, Citi, American Express, Capital One and Marriott points?

- A point is not equal to a point… or a mile

- What is a Mile or Point Worth?

Final Thoughts

The Chase Ultimate Rewards program is a fantastic one, with points that are fairly easy to earn thanks to the number of Chase credit cards that come with generous welcome bonuses and great bonus spending categories.

As you can see, there are many great ways to use these valuable points. We love Ultimate Rewards for their flexibility and versatility.

Don’t be tempted to cash out your UR points for gift cards or statement credits. The value is much greater when the points are transferred to the travel partners or used to book travel through the portal.

With some planning, you’ll soon be traveling in business class to Europe or jetting off to Hawaii for free!

Was this Chase Ultimate Rewards Points guide helpful?

Let me know below in the comments, on Twitter, or in the private MilesTalk Facebook group. And don't forget to follow me on Instagram for all sorts of tips on miles, points, credit cards, and travel.

If this post helped you, please consider sharing it!

You can find credit cards that best match your spending habits and bonus categories at Your Best Credit Cards.

New to all of this? My “introduction to miles and points” book, MilesTalk: Live Your Wildest Travel Dreams Using Miles and Points is available on Amazon and at major booksellers.

office supply stores and on internet, cable and phone services each account anniversary year. There are a lot of things you can buy at Staples, etc, so this is 5X on more than you think when you first hear office supplies!

office supply stores and on internet, cable and phone services each account anniversary year. There are a lot of things you can buy at Staples, etc, so this is 5X on more than you think when you first hear office supplies!

” it may make more sense to book Southwest flights using the Chase Travel Portal and earn Southwest miles”. Seems that the expedia powered Chase Travel Portal can’t book Southwest flights. Anything wrong?

You are right! I totally forgot and I even blogged about it 😉 https://milestalk.com/is-chase-ur-portal-losing-option-to-book-spirit-allegiant-and-southwest/ I’ll fix that now!

[…] Chase Ultimate Rewards Points: How to Earn and Redeem with Transfer Partners [Comprehensive Guide] […]

[…] Chase Ultimate Rewards Points: How to Earn and Redeem with Transfer Partners [Comprehensive Guide] […]

[…] Chase Ultimate Rewards Points: How to Earn and Redeem with Transfer Partners [Comprehensive Guide] […]

[…] Chase Ultimate Rewards Points: How to Earn and Redeem with Transfer Partners [Comprehensive Guide] […]

[…] Chase Ultimate Rewards Points: How to Earn and Redeem with Transfer Partners [Comprehensive Guide] […]

[…] Chase Ultimate Rewards Points: How to Earn and Redeem with Transfer Partners [Comprehensive Guide] […]